Never miss the fund-maker hiding in your inbox.

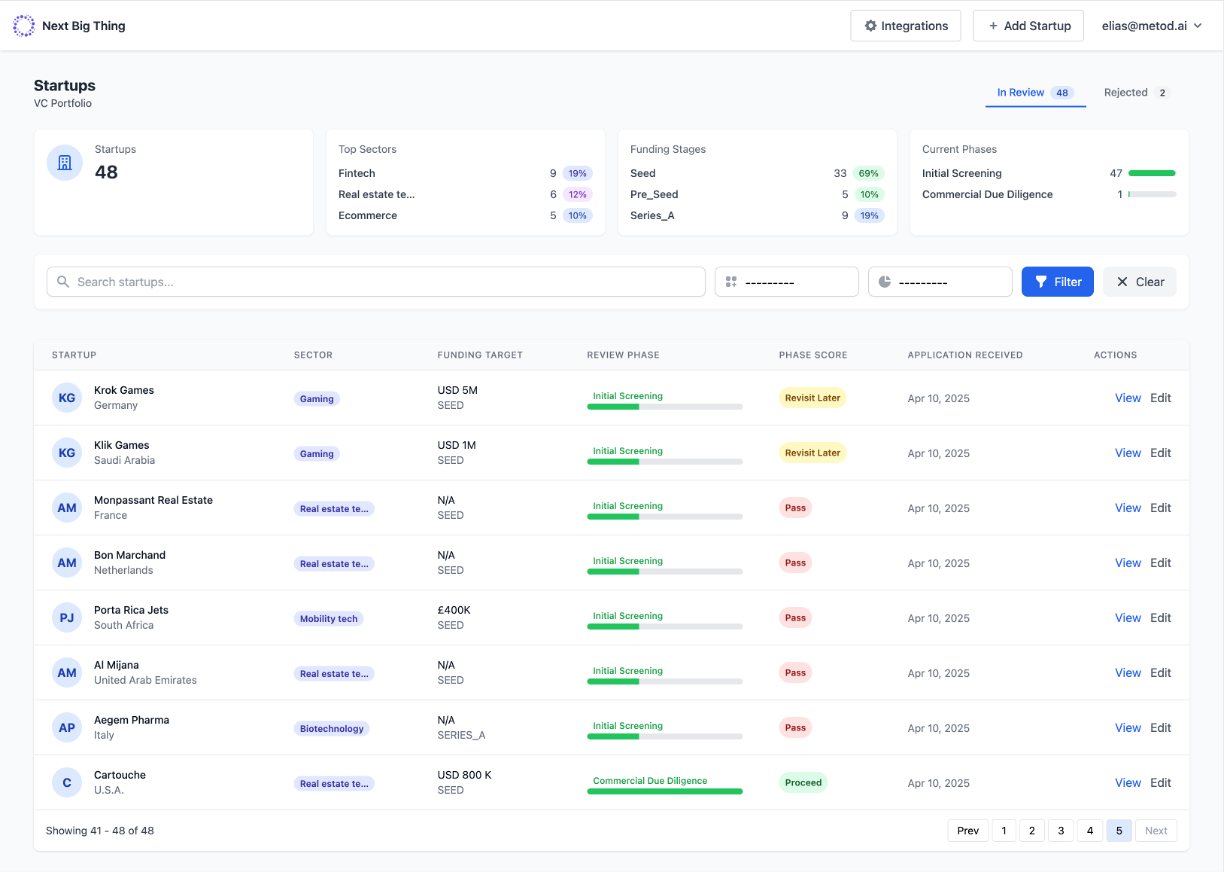

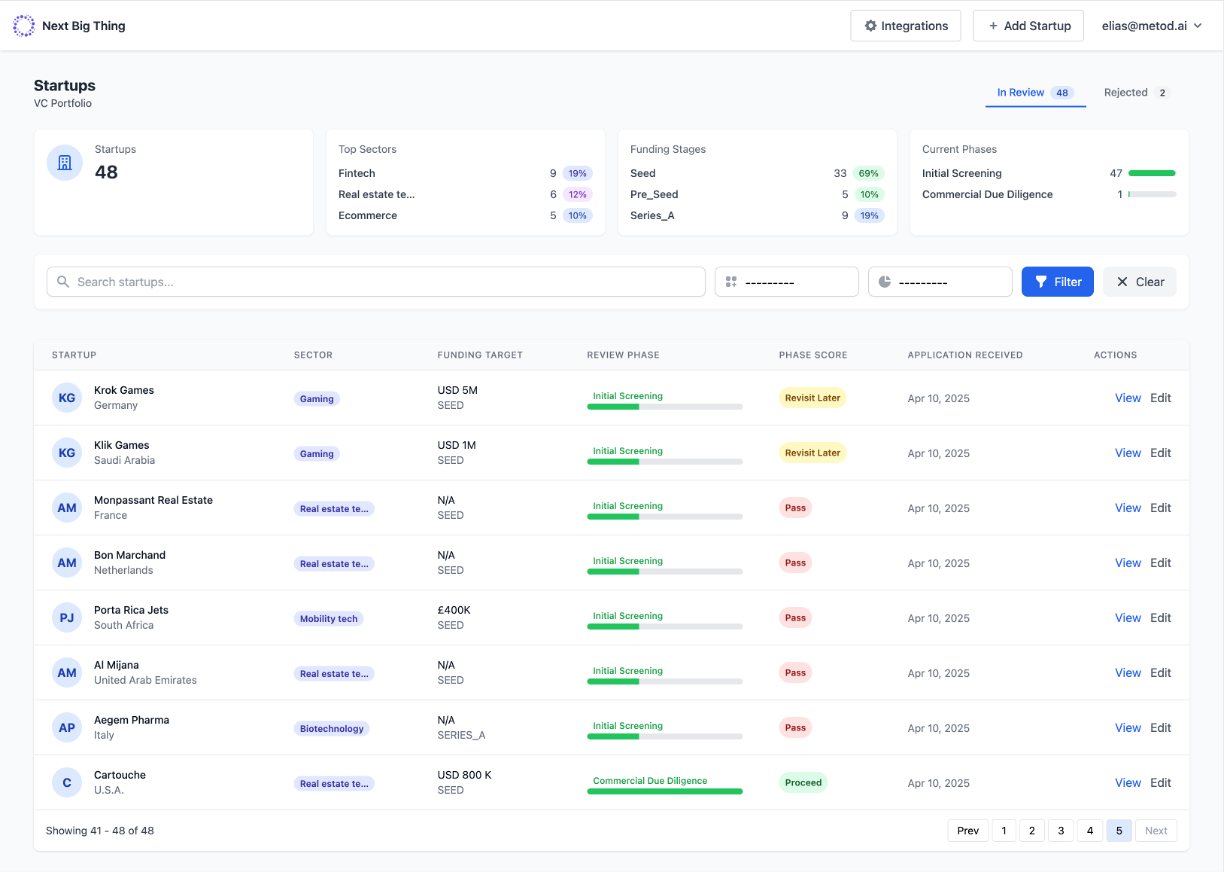

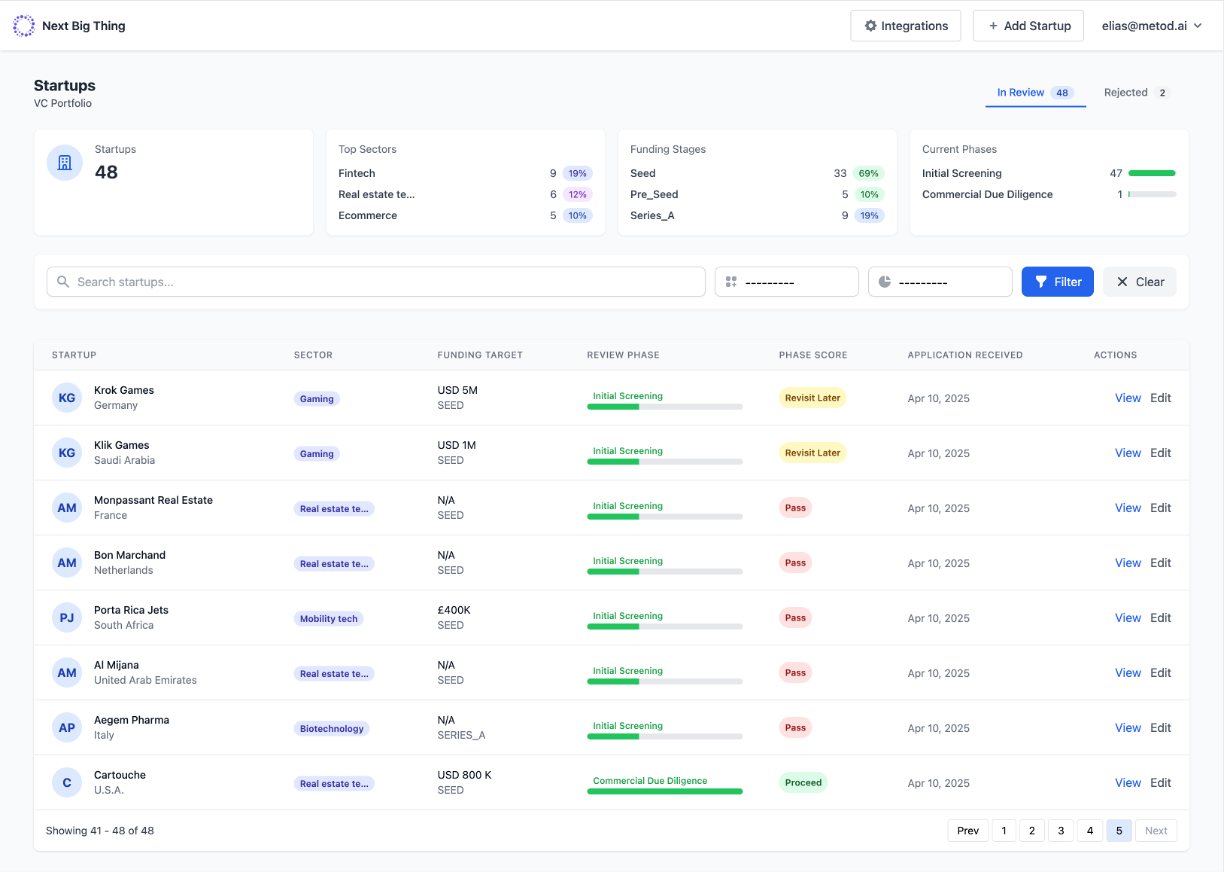

Next Big Thing automatically analyzes pitch decks & business plans, extracting market, traction, team & risk signals – so you screen 65 % faster with zero extra tabs.

Next Big Thing automatically analyzes pitch decks & business plans, extracting market, traction, team & risk signals – so you screen 65 % faster with zero extra tabs.

Smart AI that pulls the signal from the noise – tailored end-to-end for due-diligence.

Reads PDFs, PPTs & Typeform submissions, structuring every datapoint instantly.

Understands cap tables, P&L, balance sheets & forecasts – surfacing metrics that matter.

Highlights missing data, inconsistent metrics & unrealistic assumptions before you invest.

Trained on your fund thesis, stages & decision criteria — not a generic template.

Fund-Mandate Fit, Competitive Landscape, Market Sizing & Financials – out of the box.

Email, Typeform, CRMs & 8 000+ apps via Make.com & Zapier, GDPR-compliant.

Upload files or auto-ingest from email, Typeform or data-rooms.

LLMs, trained on your rubric, dissect every slide & compute a deal score.

Summary, score & red flags synced to CRM – ready for decisions.

The fund’s analysts processed thousands of inbound opportunities each year. With Next Big Thing they cut screening time by 65 % while doubling evaluation depth – all while keeping rigorous standards intact.

"Metod AI reduced our manual work by 65 % while keeping our investment standards intact. Their AI pinpoints red-flags, competitive gaps and mandate-fit in minutes, letting our team focus on high-value conviction building instead of admin."

Partner, Middle East Venture Partners

"Next Big Thing (NBT) completely streamlined our dealflow, acting as our front door to surface mandate fit and due diligence with great accuracy. NBT helped us cut our screening time by 50% and allowed us to run a much leaner team focused on high-conviction opportunities."

Managing Partner, Mandalore Partners

Custom setup → flat monthly operating fee. Typical ROI in the first 60 days.

Book a Pricing CallWe customize the platform to your methodology and launch the pilot in 4 weeks, platform fully integrated and deployed 4 weeks later.

No – NBT removes grunt work so analysts focus on nuanced diligence. Humans approve every decision.

Yes. We handle the end-to-end integration with 8,000+ apps to ensure nothing falls between the cracks.

Absolutely – we support growth PE, corporate M&A, & insurance underwriting workflows.

Private Equity, Corporate Venturing, M&A teams, and Insurers plug the same AI Workflow engine into their decision workflows.

Discuss Your Use Case