Never miss the fund-maker hiding in your inbox.

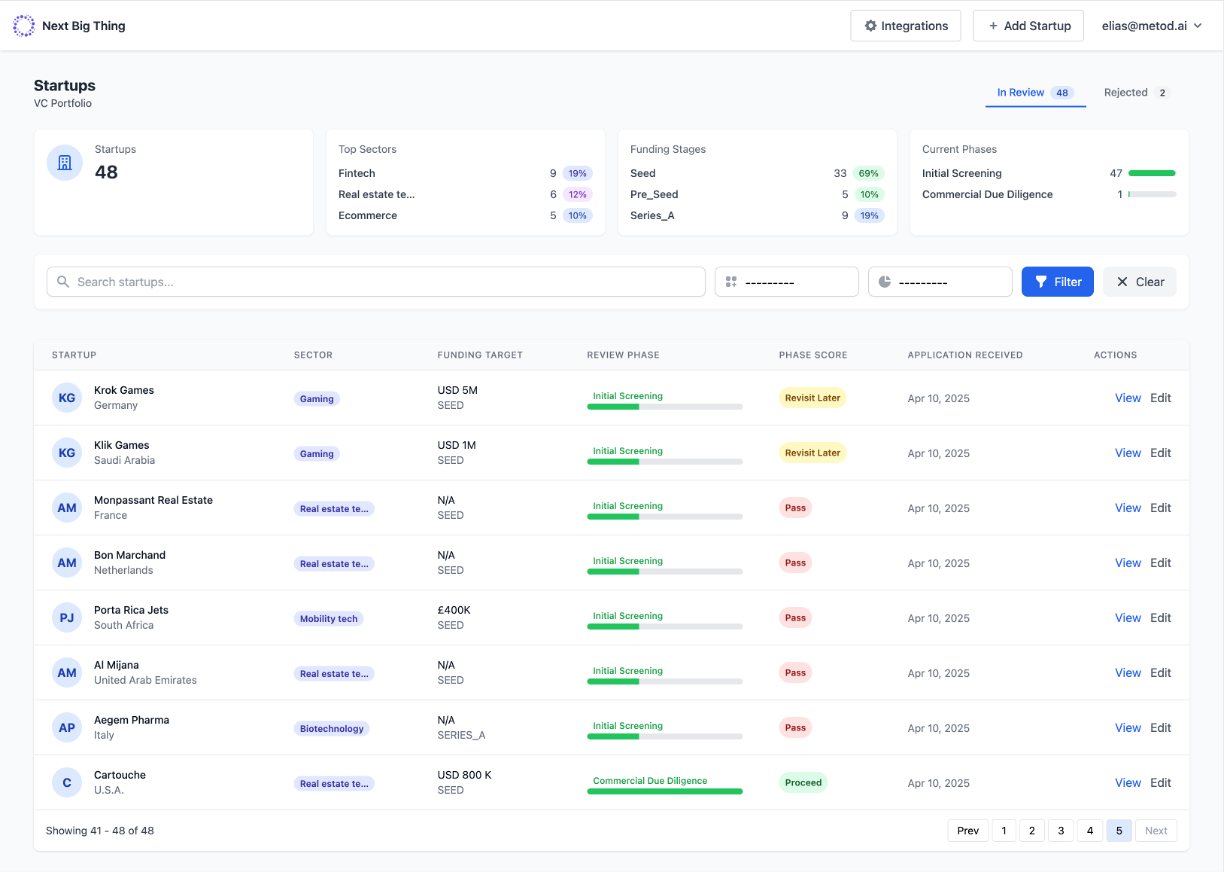

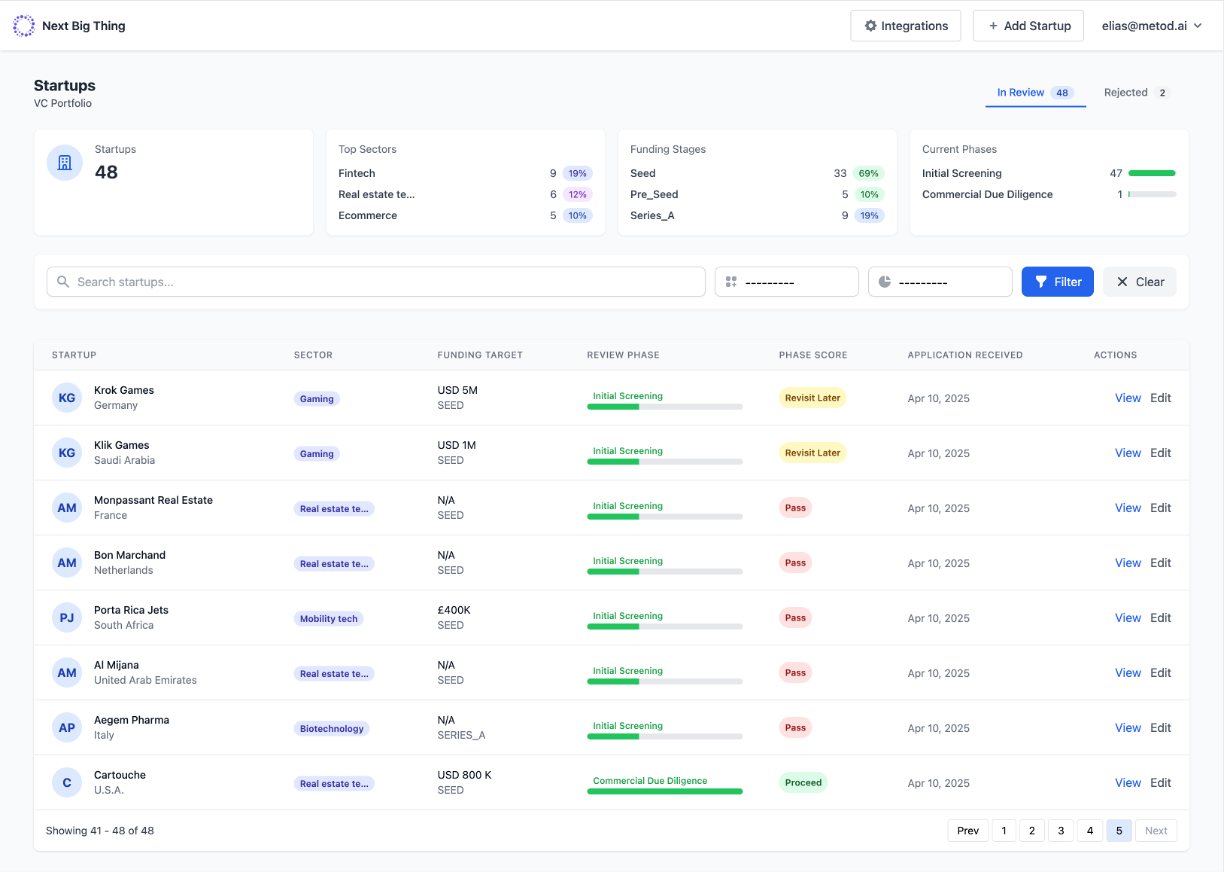

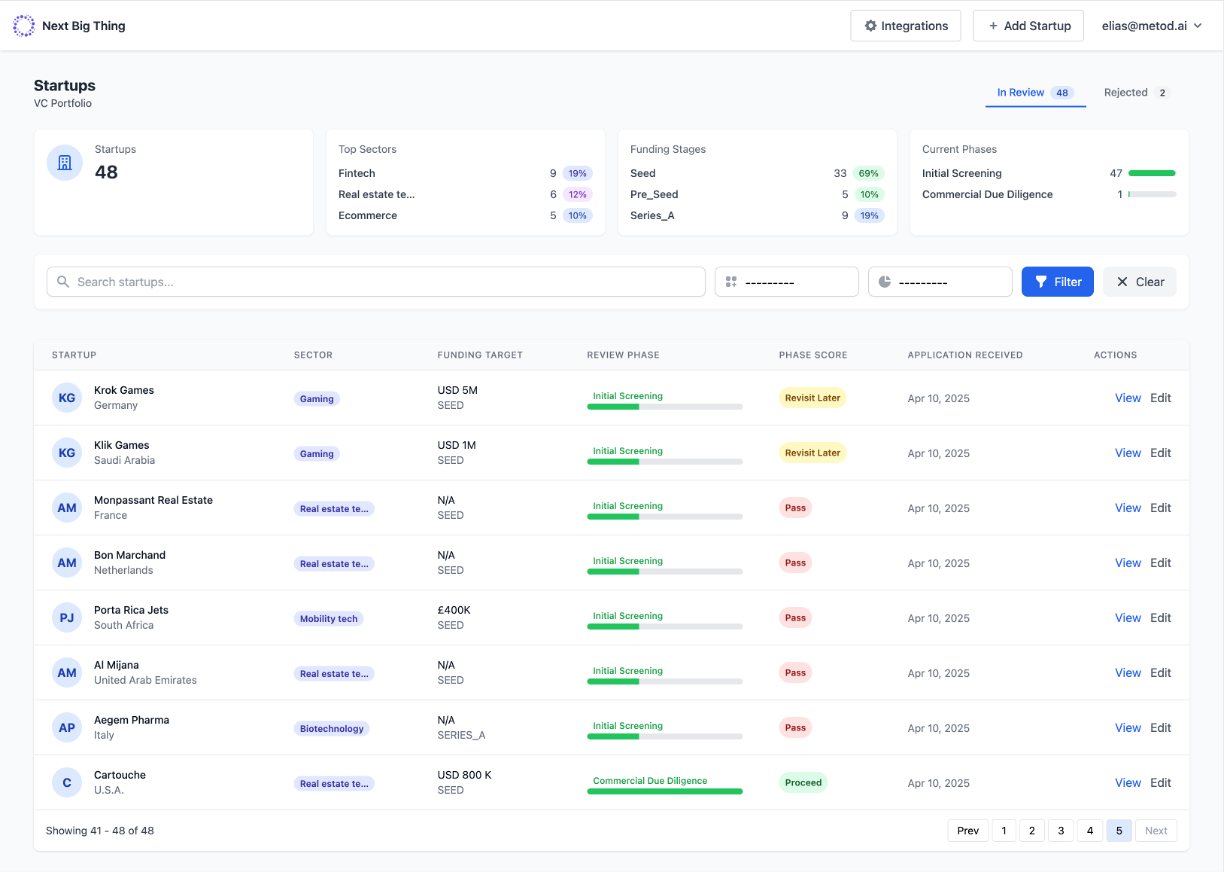

Next Big Thing automatically analyzes pitch decks & business plans, extracting market, traction, team & risk signals – so you screen 65 % faster with zero extra tabs.

Next Big Thing automatically analyzes pitch decks & business plans, extracting market, traction, team & risk signals – so you screen 65 % faster with zero extra tabs.

Smart AI that pulls the signal from the noise – tailored end-to-end for due-diligence.

Reads PDFs, PPTs & Typeform submissions, structuring every datapoint instantly.

Understands cap tables, P&L, balance sheets & forecasts – surfacing metrics that matter.

Highlights missing data, inconsistent metrics & unrealistic assumptions before you invest.

Trained on your fund thesis, stages & decision criteria — not a generic template.

Fund-Mandate Fit, Competitive Landscape, Market Sizing & Financials – out of the box.

Email, Typeform, CRMs & 8 000+ apps via Make.com & Zapier, GDPR-compliant.

Upload files or auto-ingest from email, Typeform or data-rooms.

LLMs, trained on your rubric, dissect every slide & compute a deal score.

Summary, score & red flags synced to CRM – ready for decisions.

The fund’s analysts processed thousands of inbound opportunities each year. With Next Big Thing they cut screening time by 65 % while doubling evaluation depth – all while keeping rigorous standards intact.

“Metod AI reduced our manual work by 65 % while keeping our investment standards intact. Their AI pinpoints red-flags, competitive gaps and mandate-fit in minutes, letting our team focus on high-value conviction building instead of admin.”

Partner, Middle East Venture Partners

Custom setup → flat monthly operating fee. Typical ROI in the first 60 days.

Book a Pricing CallWe customize the platform to your methodology and launch the pilot in 4 weeks, platform fully integrated and deployed 4 weeks later.

No – NBT removes grunt work so analysts focus on nuanced diligence. Humans approve every decision.

Yes. We handle the end-to-end integration with 8,000+ apps to ensure nothing falls between the cracks.

Absolutely – we support growth PE, corporate M&A, & insurance underwriting workflows.

Private Equity, Corporate Venturing, M&A teams, and Insurers plug the same AI Workflow engine into their decision workflows.

Discuss Your Use Case